The recently concluded Free Trade Agreement (FTA) between the United Kingdom and India, announced on May 6, 2025, has been hailed as a landmark achievement, promising to boost bilateral trade by £25.5 billion annually and add £4.8 billion to the UK economy by 2040.

A separate agreement known as the Double Contribution Convention (DCC) has sparked controversy, fueling anti-Indian sentiment in the UK due to widespread misinformation.

This article aims to clarify the DCC, its implications, and why the backlash is largely misplaced.

What is the Double Contribution Convention?

The DCC is a reciprocal social security agreement designed to prevent workers on short-term assignments from paying social security contributions in both their home country and the country where they are temporarily working. Specifically, it extends an existing exemption on UK National Insurance contributions (NICs) from one year to three years for Indian professionals on short-term visas in the UK. This means that Indian workers seconded by their employers to the UK for up to three years will continue to pay social security contributions in India, typically through the Employees’ Provident Fund Organisation (EPFO), rather than in both countries. Conversely, UK workers temporarily assigned to India benefit from the same exemption, paying NICs in the UK instead of Indian social security levies.

It’s critical to note that the DCC is not part of the FTA itself but a separate, parallel agreement negotiated to facilitate business mobility. Furthermore, the exemption applies only to temporary workers seconded by their employers, not to Indian nationals directly hired in the UK, those who have settled or permanently moved to the UK, or those planning to stay longer than three years. These groups remain subject to standard UK NICs and other taxes, including income tax and the NHS immigration health surcharge, which costs £1,035 per year.

Misinformation and Anti-Indian Sentiment

The DCC has been misrepresented by some opposition politicians and media outlets, leading to claims of “two-tier taxes” that allegedly favor Indian workers over British ones. Critics, including Conservative leader Kemi Badenoch and Reform UK’s Nigel Farage, have argued that the exemption makes Indian workers “cheaper to hire,” potentially undercutting UK workers, especially after recent increases in employer NICs in the UK. These claims have amplified anti-Indian sentiment, with social media posts on platforms like X framing the deal as a betrayal of British workers.

However, these criticisms are rooted in misinformation. The DCC does not create a tax advantage for Indian workers over British ones. Indian workers on short-term visas still pay UK income tax and the NHS surcharge, and they are ineligible for benefits from the UK’s National Insurance system. Moreover, the exemption is reciprocal, benefiting British workers seconded to India in the same way. The UK government has emphasized that the deal does not alter the points-based immigration system or provide new visa routes, countering claims of an “influx” of Indian workers.

The Indian government’s enthusiastic press release, which called the DCC a “huge win” for Indian service providers, may have inadvertently fueled the controversy by highlighting the competitiveness boost for Indian firms. This has been misinterpreted as an unfair advantage, despite the reciprocal nature of the agreement and its limited scope.

A Reciprocal and Common Arrangement

The DCC is not unique to India. The UK has similar social security agreements with over 50 countries, including Australia, New Zealand, Canada, Iceland, Japan, South Korea, Norway, the USA, and EU member states. These agreements, some of which offer exemptions for up to five years (e.g., Canada, Japan, and the USA), operate on the same principle: preventing double contributions for temporary workers. For example, a Canadian worker assigned to the UK for up to five years is exempt from UK NICs, paying into Canada’s social security system instead, and vice versa. The DCC with India aligns with these established practices, making the backlash against Indian workers seem disproportionately targeted.

The reciprocal nature of the DCC benefits UK businesses and workers as well. With increasing numbers of British professionals working temporarily in India for multinational corporations, the exemption ensures they are not burdened by dual social security payments, preserving their financial security and maintaining their UK pension contributions. This mutual benefit supports the growing economic ties between the two nations, particularly in sectors like IT, finance, and professional services.

The Broader Context: Indian Professionals in the UK

The controversy raises broader questions: Would it be problematic if more Indian professionals came to the UK due to this exemption? The data suggests otherwise. Indian nationals already form a highly skilled and valuable part of the UK workforce. In 2024, 81,463 work visas were granted to Indian nationals, representing 22% of all UK work visas, with significant numbers in health and care (30,301) and skilled worker roles (27,922). These professionals, including doctors, nurses, IT specialists, and engineers, contribute significantly to the UK economy.

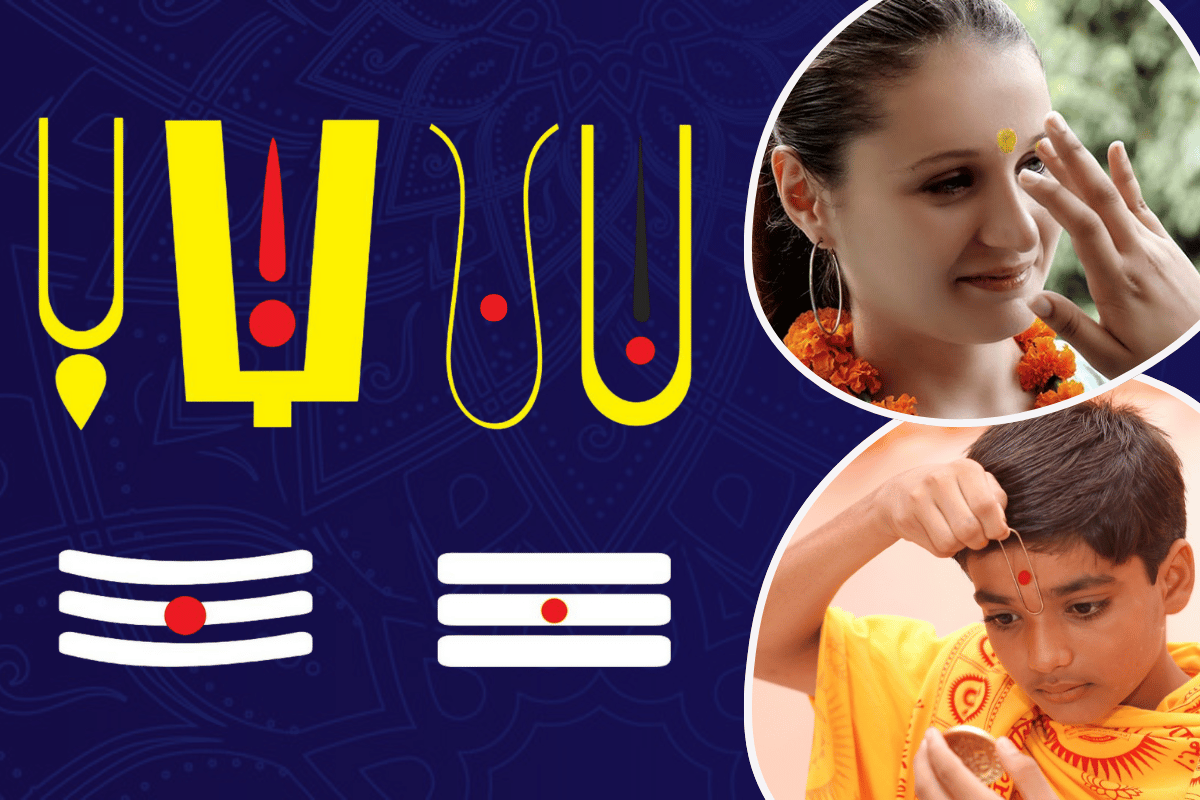

Moreover, communities of Indian origin—Hindus, Sikhs, Jains, and Buddhists—have a strong track record of integration and low crime rates compared to other groups. The 2021 UK Census reported 1.9 million people of Indian heritage in the UK, many of whom are highly educated and employed in professional sectors. Their contributions to the NHS, technology, and academia are undeniable, raising the question: Why should their temporary presence under a reciprocal agreement be viewed as a threat?

Addressing the Misinformation

The anti-Indian sentiment stemming from the DCC is largely a product of misinformation and selective outrage. The agreement’s limited scope, reciprocal benefits, and alignment with existing arrangements with countries like the USA and Japan underscore its fairness. Rather than fostering division, the DCC should be seen as a practical step to enhance trade and mobility between two major economies. By addressing these misconceptions, the UK can move toward a more informed discourse that recognizes the value of Indian professionals and the mutual benefits of the UK-India partnership.

As the FTA and DCC move toward implementation, expected within a year, both nations have an opportunity to showcase the strengths of their collaboration. Instead of fueling divisive narratives, the focus should be on the economic growth, job creation, and innovation that this historic agreement promises to deliver.